By Marco Passoni

The luxury market in China is set to grow between 4 and 6% this year, from a starting point of $63 billion, which appears to be good news for both the luxury market and the travel retail sector. I have been accused in the past of being a doubter on China, but that is not true, I firmly believe we must treat this market with sense and caution – it is not a golden goose.

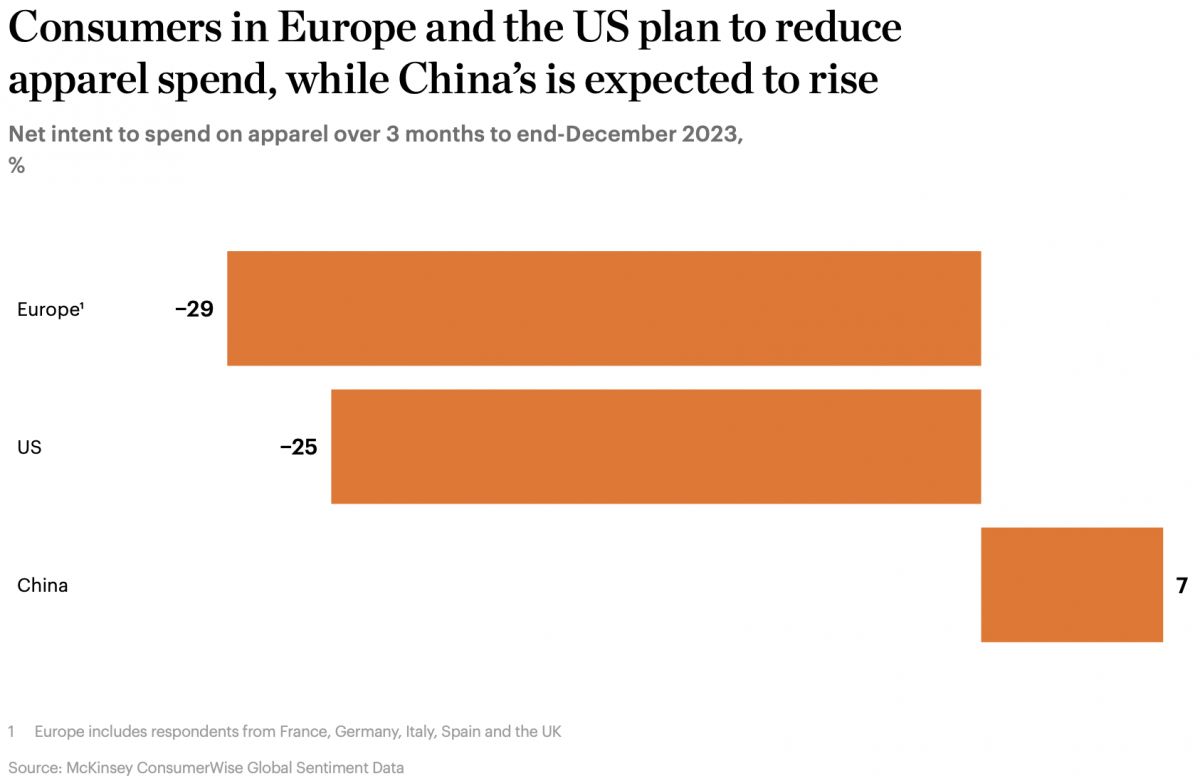

The early reading of figures from McKinsey and the Business of Fashion in their State of Fashion 2024 report does not show anything to change my mind. While the US and Europe, both key luxury and retail markets, experienced slow growth throughout 2023, China performed strongly before falling away as the year went on. The predicted growth for China is, as mentioned, between 4 and 6%, this compares to between 3 and 5% worldwide and stand against a 16% growth in China in the first half of last year. Since the market took longer to reopen, and stood at such heights, we might have expected a faster growth from China. The old normal is certainly not reasserting itself. As The State of Fashion report puts it:

“Though moving in the right direction, the projected growth rate in the year ahead stands in sharp contrast to 2020’s 32% and 2021’s 40%.”

But why is this the case? A slow return to spend in China is in contrast to a rising amount of savings in the country. Chinese savings stands at up to 45% of GDP and the gross savings rate is “historically high” says the World Bank. This is compared to falling savings in the US and Europe. As many will point out, the stated desire to spend from Chinese shoppers is also high, with 69% saying they intend to “splurge” on shopping, which puts spending plans from Chinese shoppers ahead of those in the US and Europe. In this context, clothes and jewellery lead the way, alongside footwear.

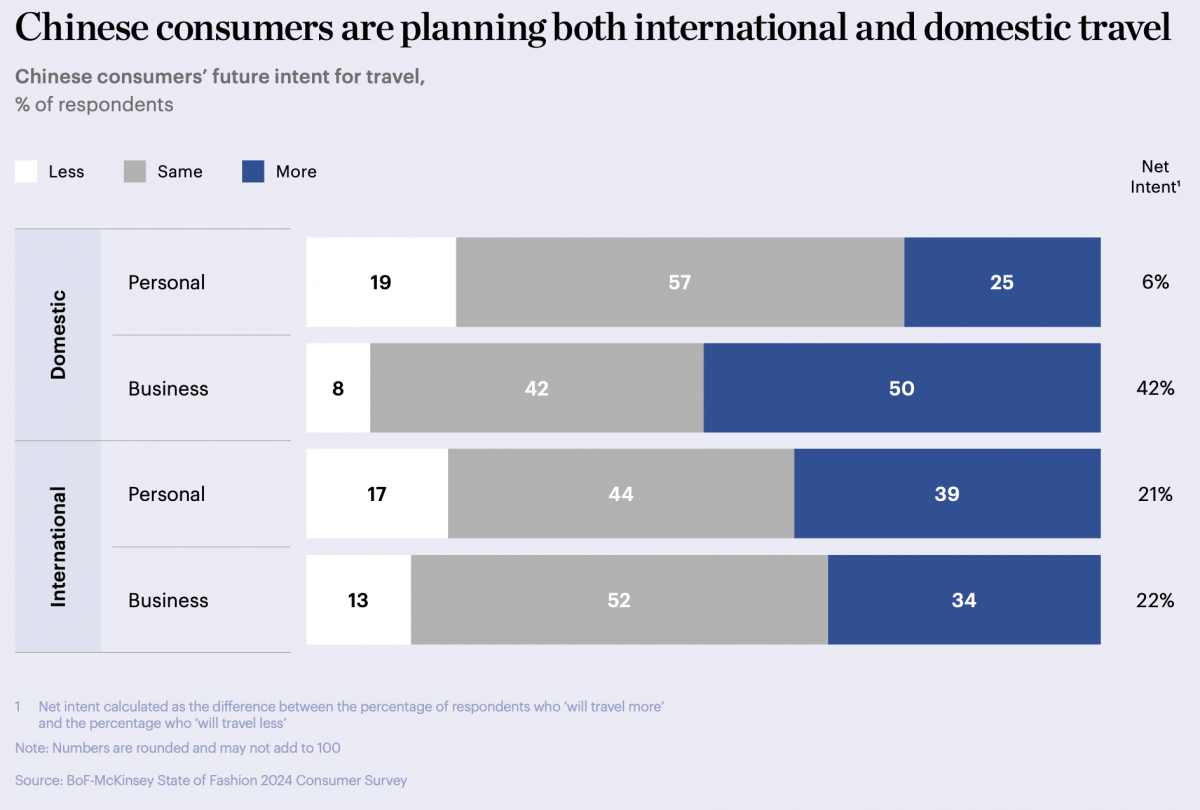

In good news for travel retail, and international luxury, spend is also recovering abroad. Spend by Chinese tourists in Asia Pacific is already 109% of that seen in 2019, but that positivity does not spread further afield. Some may point to the need for travel recovery, but with capacity to Europe up 54%, spend by Chinese tourists in the region is just 41% of that seen in 2019, and that is being boosted by ultra-high-net-worth shoppers whose average transaction is up 28%.

We must hope that these figures shift as travel continues to develop, and it is good that the hunger appears to be there. Chinese overseas travel is expected to hit between 70 and 100% of 2019 levels this year, with full recovery in 2025. These shoppers want experiences and shopping trips, but the insights from McKinsey and BoF highlight that the focus has shifted from spending outside China:

“While China’s 460 billion yuan ($63 billion) personal luxury market will continue to grow in the long term, domestic shopping may account for 60 percent to 70 percent of the spend (and international 30 percent to 40 percent). McKinsey analysis indicates a likely permanent reversal from pre-pandemic levels of about 40 percent domestic and 60 percent international.”

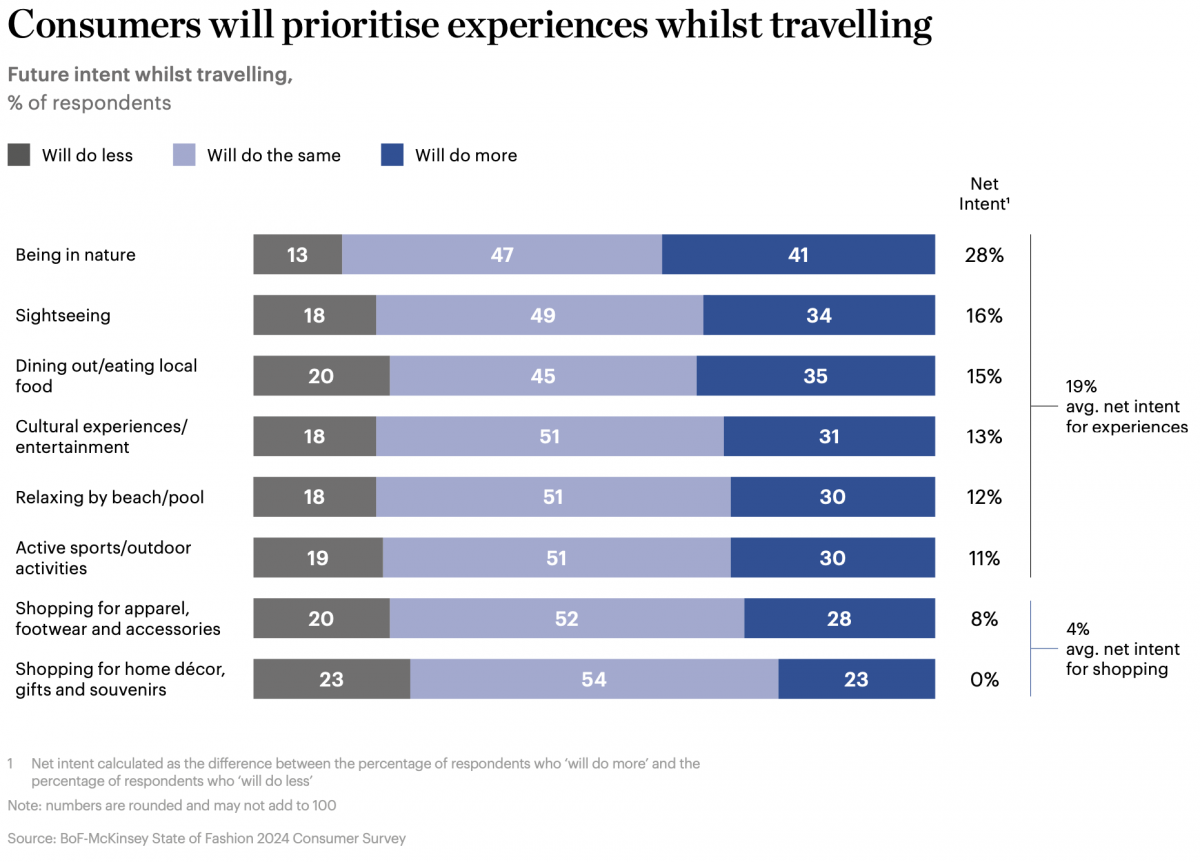

With less spend on the table, it means that any efforts to capture these shoppers much be done right – so we need to fully understand and cater to the change in their priorities. Shopping now is the seventh priority for Chinese tourists, well behind trying out local food, being in nature and seeing the sights. The message is clear: a local experience is king.

Even in the retail space, what shoppers want has shifted, with BoF and McKinsey highlighting a demand for digital engagement, niche products and luxury, especially jewellery and watches. I personally cannot agree more with the McKinsey team when they argue that brands must tailor their offer to the shoppers’ specific desires.

But should those shoppers be Chinese? Not exclusively. The report highlights great potential from other growing markets, especially India, where 85% of executives say they are optimistic about the world ahead, and consumer confidence is at a four-year high. It seems an understatement to say, as the report does, that India is “promising”.

As I look at the figures and the story behind the data in this report, one thing become clear to me: China and its shoppers remain a key player in both the luxury and travel retail markets, but is it still a growth market with potential to carry the future? No, I am afraid it is not.